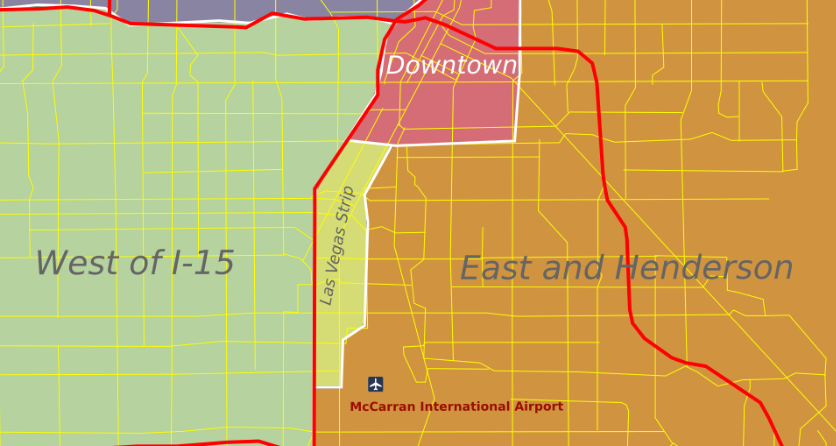

Are you trying to decide on a location for your Las Vegas business?

Success in business depends on a lot of key factors. Traffic patterns, demographics, lifestyles, and competitors matter when it comes to service-oriented types of business. Choosing your Las Vegas business location determines the ZONING LAWS, REGULATIONS, and TAXES that apply to the business.

Here are some of the things that we strongly suggest that you should consider in choosing your business location:

REGION-SPECIFIC BUSINESS EXPENSES

Expenses in establishing a business could vary on different factors such as:

- Salary

- Minimum Wage laws

- Property Values

- Rental Rates

- Business Insurance Rates

- Utilities

- Government licenses and fees, such as the Nevada State Business license

LOCAL ZONING ORDINANCES

Zoning ordinances are established by the local government to control the development of land areas and specify the neighborhoods for commercial, residential, industrial use.

It is important to check and ensure that the area of your establishment conforms to the zoning requirements set by the local government. The business operation can be restricted or banned entirely if this is not adhered to.

Make sure to check with the department of city planning or a similar agency to verify zoning laws that apply to your business location.

STATE AND LOCAL TAXES

Manufacturing Companies, Financial Institutions, and Tech Startup companies tend to concentrate in certain areas of the country for a good reason. Some States have favorable tax environments that are favorable or convenient for certain kinds of business or establishments.

Knowing the tax landscape of the city, state, or county is an important factor in considering a place for business. Make sure to check by visiting the State of Nevada Department Taxation and resources at SilverFlume

STATE AND LOCAL GOVERNMENT INCENTIVES

Some states offer tax incentives. Some local government offices provide an inducement to small businesses in the form of a special tax credit, state-specific loans for small businesses, and other forms of financial reward.

These benefits and program incentives are often associated with urban redevelopment, job creation, energy efficiency, and technology.

To find more about these programs and related information, make sure to check State and Local Government websites.

FEDERAL GOVERNMENT INCENTIVES

Small Businesses contracting with the government that are based in undeveloped areas receive benefits from the Federal Government in the form of a program.

To verify if preferential access to federal procurement opportunities applies to you or your business, make a point to check the HUBZone (Historically Underutilized Business Zones) Program.

Now that you know the important things to consider in choosing a location for the business and you have given it some thought, you may start processing the registration of your business by signing up on Silverflume or applying for a business license by mail.